How to Verify Your Self-Managed Super Fund on AUDD Digital

Verifying your Self-Managed Managed Super Fund after Registering for a Business Account

Auddrey

Last Update setahun yang lalu

If you're embarking on the exciting journey of incorporating AUDD, the Australian Dollar stablecoin, into your Self-Managed Super Fund (SMSF), you've come to the right place. We understand that stepping into the world of digital currency can seem daunting, especially if you're new to blockchain technology. That's why we've created this easy-to-follow guide to help you seamlessly verify your company on the AUDD Digital platform. Our aim is to provide you with a clear, step-by-step process, ensuring that even those without prior knowledge can navigate this with ease and confidence.

Let's begin by understanding the key components of the verification process and how it empowers your SMSF in the digital currency space.

Understanding the Verification Process

The verification process on AUDD Digital is a crucial step in securing and legitimising your SMSF's presence in the digital currency market. It involves two main components:

- Verifying the SMSF

- Appointing and Verifying the Account Manager

What is an Account Manager?

The account manager has a critical role because he or she is in charge of managing your SMSF's AUDD Digital account. This should be someone in the SMSF who has significant control or influence, such as a Trustee. In some cases, a Trustee may also nominate an external representative to be their account manager, with appropriate documentation provided as evidence.

Where to Start: Accessing the Onboarding Portal

The easiest way to start the verification process is by heading to the Onboarding Portal here. This will ensure a smooth experience by providing all necessary information and allowing you to jump between sections as needed.

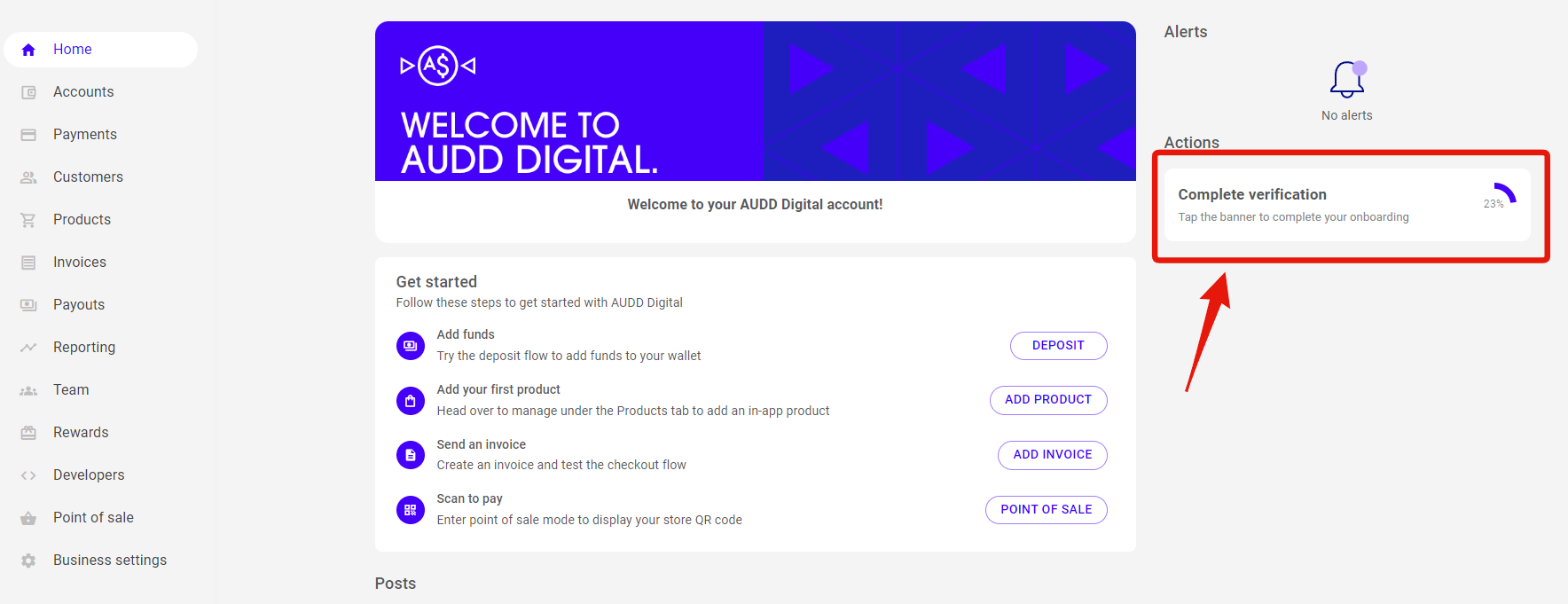

Alternatively, you can access the Onboarding Portal by clicking on the 'Complete verification' task listed on your AUDD Digital dashboard.

What to Provide in the Onboarding Portal

The Onboarding Portal is split into two sections: User Onboarding and Business Onboarding. These are visible in the menu on the left-hand side of your screen.

To access the onboarding sections, simply click the arrow to expand or collapse the onboarding menu.

The 'User Onboarding' section is specifically designed for the account manager to provide their personal information for verification. This includes:

- Mobile Number Verification

- Personal Details

- Address Verification

- Proof of Identity

The 'Business Onboarding' section focuses on the details pertaining to the SMSF. While the terminology used is generally applied to business accounts, what you provide on behalf of your SMSF will follow the same convention:

- Business information

- Business Location

- Legal Information

- Incorporation Documents

- Tax Certificate

- Financial Statement

- Shareholder Information

Achieving Tier 2 (Starter Account) Verification

Tier 2 verification on AUDD Digital is an essential step for enhancing the functionality and limits of your SMSF's account. A summary of the requirements can be found in the table below. For further assistance, we provide a detailed breakdown of what is required for both the account manager and the SMSF to achieve Tier 2 verification status in the sections beyond.

| Account Manager (User Onboarding) | SMSF (Business Onboarding) |

|---|---|

| Verification of mobile number, personal details, and residential address. | Provision of registered name, operational address, and SMSF registration numbers (ie.: ABN, ACN) |

Account Manager

Mobile Number Verification:

- Purpose: This step is crucial for two-factor authentication and security alerts.

- Process: Enter your mobile number and follow the prompts to receive a verification code via SMS.

- Verification: Enter the received code on the platform to verify your mobile number.

Personal Details Submission:

- Information Required: Full legal name, date of birth, and identification numbers.

- ID Documents: Valid documents include a passport or driver's license. You'll need to provide the number and card number of these documents.

- Accuracy: Ensure that all information is accurate and matches the details on your official documents.

Residential Address Verification:

- Importance: This confirms your location for legal and security reasons.

- Details: Provide your current residential address, not a business or PO Box address.

- Proof: You might be asked to provide a utility bill or bank statement as proof of residence. This is optional to provide.

SMSF

Business Information:

SMSF Name: Provide the registered name of the SMSF as it appears on legal documents.

Accuracy is Key: Ensure the name matches exactly with your official registration documents to avoid discrepancies.

Business Location:

- Operational Address: Submit the physical address of the place where your SMSF is registered to.

- Exclusions: PO Box addresses are not accepted as they do not provide the actual location of the SMSF.

Legal Information:

- Registration Numbers: Include essential legal identifiers like the Australian Business Number (ABN) or Australian Company Number (ACN).

- Official Documents: You might be required to upload documents that verify these numbers, such as registration certificates or official notices. This is optional to provide at this Tier level.

Achieving Tier 3 (Standard Account) Verification

Achieving Tier 3 verification on AUDD Digital is an essential step for enhancing your account's capabilities and security. This level of verification involves more detailed checks for both the account manager and the SMSF. A summary of the requirements can be found in the table below. For further assistance, we provide a detailed breakdown of what is required for both the account manager and the SMSF to achieve Tier 3 verification status in the sections beyond.

| Account Manager (User Onboarding) | SMSF (Business Onboarding) |

|---|---|

| Proof of Identity submission (liveliness check) | Incorporation Documents and Trustee Information |

Account Manager

To verify the account manager's identity to a Tier 3 level, the account manager must complete the Proof of Identity submission, also known as a liveliness check. You will need to take two photos with your chosen photo ID (such as a passport or driver's licence):

- Photo with ID: Take a clear, colour photograph of yourself holding your identification document (ID) next to your face. Ensure that both your face and the details on the ID are visible and legible.

- Photo with ID and AUDD Account: Take another photograph where you hold the same ID next to your computer or device screen displaying your open AUDD Digital account. This photo should clearly show the ID and the visible AUDD account on the screen, establishing a connection between your identity and the account.

Once submitted, this will complete the onboarding requirements for your designated account manager.

Tip: Avoid using filters or editing the photos, as they must represent an accurate and current likeness. Ensure good lighting and clarity to avoid any delays in the verification process.

SMSF

For the SMSF to achieve Tier 3 verification, the following documents and information are necessary:

Incorporation Documents:

Upload a current extract from the Australian Securities and Investments Commission (ASIC). This document should detail the SMSF's registration information, including the names and details of directors, secretaries, and members (referenced as shareholders) holding more than 25% of shares.

Alternatively, you can provide the Deed for the SMSF. This document can be accepted so long as it meets the following conditions:

- Contains the ABN/ACN of the SMSF

- Lists the Director(s), Secretary(ies), and Member(s) of the SMSF (may be identified as 'Trustees')

- Contains the registered address of the SMSF

Shareholder Information:

For any Trustee or Member holding ownership of more than 25% of the SMSF, a copy of their ID is required.

Applying for Tier 4 (Pro Account) Verification

Applying for Tier 4 verification on AUDD Digital is a significant step for SMSFs, offering enhanced transaction limits and features. To ensure full compliance and security, this level of verification necessitates detailed financial documentation. As Tier 4 accounts are granted higher limits, supporting evidence you submit must justify why these higher limits are required. Here's a breakdown of the documents you will need to provide on behalf of your SMSF:

Financial Statement:

- Document type: A recent bank statement; no older than 6 months.

- Purpose: This document is used to verify the bank account where the SMSF's balance is held as well as the total balance.

- Details to Include: Ensure the statement includes the SMSF’s name, address (matching the one provided in the Business Location section), account number, and recent transactions.

- Format and Submission: Upload the document in a clear, legible format. Acceptable formats usually include PDF or high-quality image files. Ensure that all relevant details are visible and unobstructed.

Tax Certificate (Income Statement):

- What Qualifies as an Income Statement?: This can be an annual return prepared, an independent audit, a balance sheet or profit and loss statement, or a letter from your SMSF Auditor or Accountant.

- Content Requirement: The key is to provide a document that clearly shows the value of funds assets, in line with the Administering and Reporting requirements set out by the Australian Tax Office (ATO). Typically, this would include the the last financial year.

- Authenticity: It’s crucial that the documents are official and verified. For instance, an audit should be the final submitted version, known as your SMS Annual Return (SAR).

Applying for Tier 5 (Elite Account) Verification

Tier 5 verification on AUDD Digital represents the highest level of trust and capability within our platform, designed for users with significant transaction volumes. Tier 5 is not a standard tier that can be applied for directly. Instead, it is an invitation-only tier, offered to users who demonstrate a high volume of transactions and a strong track record of compliance and security on the AUDD Digital platform.

Criteria for consideration include:

- Significant Transaction Volume: Your account must exhibit a substantial level of transaction activity. This is assessed over a period and includes both the frequency and the value of the transactions.

- Account History and Compliance: A consistent history of adhering to the platform's rules and regulations is crucial. This includes no breaches of security protocols and complete compliance with all previous tier requirements.

- Operational Necessity: The need for higher transaction limits and enhanced features typically associated with Tier 5 should be evident from your account's usage patterns.

For any enquiries regarding Tier 5 verification or if you believe your account qualifies for consideration, please reach out to our dedicated support team at [email protected].

Completing the Verification Process

Take a moment to review all of the details you have entered before submitting any information or documentation. Ensure that all information is correct and that the documents you upload are clear and legible. This step is crucial to avoid any delays in the verification process due to errors or missing information.

When you proceed to the next section, any information or documents you supply are automatically saved and submitted to the team. If you made a mistake or need to provide more information, simply return to that section using the menu on the left side.

The verification process may take some time as our team thoroughly reviews your submitted documents and information. Depending on the nature or complexity of the SMSF's structure and the number of members or trustees involved, the length of this process can vary.

Once the verification process is complete, you will be notified via email. This email will notify you whether your application has been approved or if additional information is required. Following successful verification, you will have access to all of the features available for your account tier. This includes increased transaction limits and other features unique to your verification level.

Our goal at AUDD Digital is to provide a safe and seamless experience for all of our users. We are here to help you every step of the way, whether you are setting up an account for your Self-Managed Super Fund, or need assistance with the verification process. If you have any questions, concerns, or encounter any issues, please contact our support team at [email protected].